Today’s post is by Russell from Stock Millionaires.

Get a free stock from Robinhood by signing up here. You don’t need any money in your account to get the free stock. You can get up to $195.30 worth of a stock.

Before we were full-time bloggers, my wife and I made money from stock trading online.

We were moderately successful quite quickly, and we used some of the profits to pay down some of our student loan debt.

We have continued to trade stocks on a part-time basis for the last few years and we love it.

We even started a blog dedicated to learning stock trading called Stockmillionaires.com.

Last month we increased our stock trading portfolio value by just over 10% by trading low-cost stocks.

Here are some of the top reasons that we think might convince you to try stock trading online:

- Start-up costs can be as little as $100. We will show you how to start trading stocks for free!

- Stock trading has one of the biggest earning potentials of any work-at-home job. Some stock traders are making millions of dollars trading stocks online.

- Flexible hours – you can trade part-time or full-time from the comfort of your home.

- Quick returns – traders often make money in minutes or days.

- It is exciting and fun!

It can be done while traveling, working at home or even while at your day job.

There is a relatively steep learning curve to overcome (online stock alerts services and trading courses can really help with this).

It’s also worth noting any money you make in the market from selling stocks will be taxed as income.

Claim your free Robinhood stock here.

How Risky Is Stock Trading?

Stock trading does have some risk involved, but it can be controlled.

Traders learn to control the risk using a variety of techniques.

It is important to realize that stock trading is very different from gambling – there is an element of luck involved, but there is also a lot more strategy to successful stock trading.

The biggest factor in reducing risk in trading is learning to control your emotions.

Greed and fear are often responsible for big losses.

They influence when you sell a stock, how much money you have invested in a position and when you take your profits. It is a huge mind game.

How Is Stock Trading Different to Investing?

We trade stocks, which means we do not buy and hold a position for more than a few days.

This is quite different from investing. Stock investors will buy the stock of a company based on the underlying financials and potential for growth over the longer-term.

Traders often do not care about the growth potential of a stock.

Instead, we just want to make a profit from the near-term price movement. We will often buy a stock, hold it overnight and sell it the next morning for a profit.

Actively trading a company’s stock has some advantages over investing.

It allows you to recycle your money very quickly and benefit from the compounding effect.

The short-term gains with trading are often much larger than investors expect to make – we often make 20% per trade!

Related: Beginner Guide For People Completely New To Investing

P.S. Sign up below for the FREE ultimate financial planner that includes printables like: debt tracker, income tracker, annual budget summary, savings challenges, financial goals, and debt thermometers!

Robinhood – the Free Mobile Online Stock Trading Platform

We wrote up a full review of our experience with the Robinhood app, but here is a brief overview.

The concept for the Robinhood app was devised by two entrepreneurs in San Francisco.

They recognized a strong market need for a free way for millennials to start investing and trading in the stock market.

The Robinhood app was aimed at millennials and deliberately designed it to be used on cell phones (we also use it on our laptops).

Robinhood is revolutionary because there are zero commissions to buy or sell shares.

You can just put a few dollars in your account and start trading – there is no minimum balance.

This makes it possible for the average person to start trading, instead of just the prosperous upper-middle class.

What Type of Trading Can Robinhood Be Used For?

Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation.

It can be used to buy stocks, options, cryptocurrencies and exchange-traded funds (ETFs).

The app can be used to buy stocks for short-term trading.

It has the functionality of an expensive conventional brokerage platform but without any of the cost.

Claim your free Robinhood stock here.

How Does Robinhood Make Money?

Robinhood makes money from its premium subscription service.

Robinhood Gold costs $5 per month and includes more than margin trading capabilities. Additional research tools are also provided in the fee.

This is called margin trading and it provides traders with leverage to buy more stocks with.

We have always just used the free service with Robinhood.

The screenshot above shows the Robinhood trading dashboard.

The graph illustrates how the value of your account has changed – thankfully ours has grown!

The panel on the right shows the prices of stocks, including the 1 share of ZNGA that we currently have in our portfolio.

The Golden Rules We Follow When Trading

We follow a few rules that help us to consistently make money trading stocks.

Here are the 5 rules that we use:

- Have a trading plan and stick to it. Never let emotions change your trading plan.

- Have patience with the trade. Warren Buffet once said that the stock market is a device for transferring money from the impatient to the patient.

- Focus on how much you could potentially lose in a trade. Plan for the worst but hope for the best applies in trading. We never trade with money that we cannot afford to lose.

- You will have trades that lose money. We try to cut our losing trades quickly to prevent large losses wiping out our winning trades.

- It is equally important to allow your winning trades to continue towards your profit target. If you sell them for a tiny profit it will be much harder to make money overall.

We recommend learning a simple stock trading strategy.

We only trade the highest probability setups to ensure the best chance of success.

Claim your free Robinhood stock here. You don’t need any money in your account to get the free stock. You can get up to $195.30 worth of a stock.

The Simple Stock Trading Strategy We Use to Make Money

We buy and sell stocks that are priced under $20 per share.

These cheaper stocks tend to have more volatile price action which enables larger percentage gains during short-term trades.

The ‘blue-chip’ stocks like Google, Apple or IBM tend to be favored by long-term investors because they have intrinsic growth potential and price stability.

These are not favorable attributes for short-term trades.

For example, we recently traded a stock that trades around a dollar per share and it increased by 50% to $1.5 per share overnight.

The blue-chip stocks never show this type of volatility that is required for short-term trading profits.

Make no mistake – the companies behind the stocks that we trade are not great companies.

They usually have debt, poor cash-flow and often no real products yet.

They would be terrible long-term investments, but we make money quickly by trading the predictable nature of the stock’s price action.

How We ‘Predict’ the Price Action of a Stock

Most people that are not traders think that short-term price fluctuations are random and unpredictable.

However, they are not as random as they may appear to the untrained eye.

The use of patterns in the price charts of stocks is called technical analysis.

We use it to give us an indication of where the price of a stock may go in the near future – either up or down depending on the pattern.

Technical analysis is a well-established trading technique than many people use to make money trading.

The reason that it works is due to the fact that people all recognize the patterns forming and come to the same conclusion!

A pattern that signals that the stock will likely go up will encourage people to buy in, thus the prediction comes true!

The buying pressure will increase the price of the stock. It is a self-fulfilling prophecy.

A complete tutorial on the intricacies of technical analysis is outside the scope of this article.

I will try to outline the strategy that we use to make some extra money trading stocks.

The core principle at the heart of the technical analysis is the idea that the price action of a stock will repeat over and over again.

This forms a recognizable pattern that gives a higher probability that the stock will continue the pattern.

We look for one of the classic price patterns forming and purchase the stock. We anticipate the pattern continuing in a reasonably predictable direction.

Claim your free Robinhood stock here.

Our Favorite Chart Price Pattern Is Called the Channel Pattern

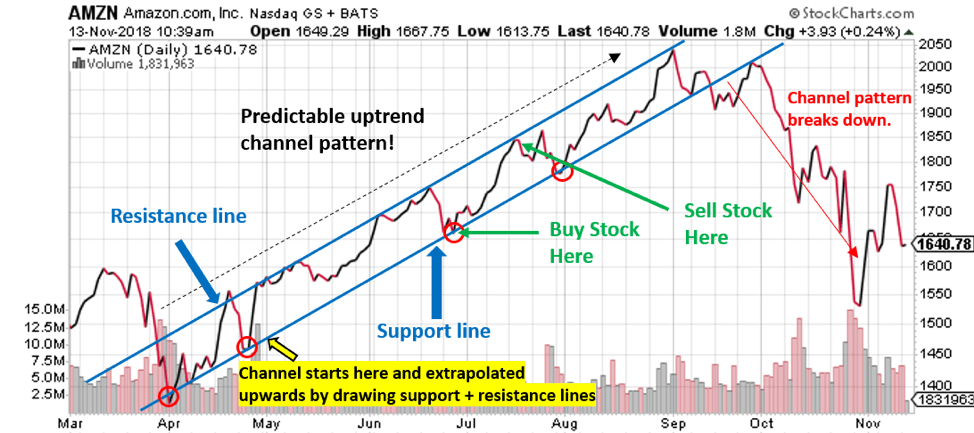

I want to show you exactly what I mean by repeating price patterns.

The easiest pattern to show you is called the ascending channel pattern.

It is so simple all you need to do is draw two lines on a price chart to get an indication of the price direction and pattern.

A good example of the ascending chart pattern is shown in the chart below. It shows the stock price of Amazon over the last 8.5 months.

This price chart is from the free charting site called Stockcharts.com.

You can plot the price chart versus time of any stock and look for patterns in the price action.

What is clear from the above chart is that the price of the stock seems to bounce between the two blue lines (I just added the blue lines by connecting the price dips and peaks).

The bottom blue line is called ‘support’ and the top one ‘resistance’.

These are the prices that people are watching to buy or sell the stock. You can do the same! The two blue lines form an upwards trending price channel.

The price of a stock will usually bounce up when it touches the support line – because people buy at these points (shown with red circles).

When the stock price rises and meets the top blue (resistance) line, this is the sell signal for many traders.

Thus, the price decreases back down until buyers’ step in around the support price.

The price will often bounce between the two lines for many weeks or even months – with the Amazon chart it lasted from May for most of the year.

Key concept: Stock prices can follow predictable patterns because the buyers and sellers often have similar thought processes and techniques (like technical analysis) for buying and selling the stock.

Claim your free Robinhood stock here. As stated already, you don’t need any money in your account to get the free stock. You can get up to $195.30 worth of a stock.

How to Make Money Trading the Channel Pattern

Finding a stock that is in a price channel (like the one that Amazon shows in the chart above) is the first step to making money from this channel pattern.

Once you have found a pattern, you can then draw the two blue lines in to extrapolate the price direction and make a prediction of where the stock price will go in the near future.

Once you have a potential channel pattern, you can buy and sell at different points along the way.

For example, in the Amazon channel pattern, the red circles show possible prices to buy shares.

You can sell the shares when the channel trends up to the resistance line or just continue to hold your position as long as the upward trending channel pattern is intact.

Price patterns (like the up-trending channel pattern) do not always continue.

Often, they just fail and never even form a proper channel or pattern.

They key is to realize that the patterns are higher probability trading setups – they might work 70% of the time. But they will never work 100% of the time.

This is where money management and discipline play a huge role in successful stock trading.

This is a crucial concept in trading – always cut your loss quickly if a pattern fails or the price is going against you. Even if it means taking a small loss!

A good illustration of this, and why it is so important can be seen in the Amazon chart pattern above.

You can see that in the middle of September, the price broke through the support line.

The stock then lost about 30% of its value in 4 weeks!

If you had just purchased the stock at the support line in September, you would have lost a lot of money as the pattern broke down.

Conclusions

We use the Robinhood trading app for commission-free trades.

This may be a good match for someone that wants to try out trading as a way to make some extra money.

We use a disciplined approach and only trade stocks that show a high probability chart pattern. By cutting out losses quickly on the losing trades, we are able to consistently make money trading stocks.

We try to make sure that our winning trades give more profits than we lose on the trades that go against us.

We just trade three simple chart patterns over and over again. Keeping it simple has worked well for us!

Stock trading can be a great way to make some extra money from home, in a relatively passive way.

You can get started with stock trading for as little as $100. Why not give it a try?

Another free option: Trade stocks with WeBull

WeBull is a free commission trading app with many benefits and features that make it superior to similar trading apps.

WeBull is designed for intermediate and experienced traders, with many tools that beginner traders will enjoy as well.

As an added bonuses, all new WeBull customers get free stocks.

How can I get started with WeBull?

- Sign up for a WeBull account here.

- Download the app on iOS or Android.

- Go to menu > “My Free Stock” > Click “Get It Now” which starts your registration and open a brokerage account.

That’s it! Getting started is really easy. When you sign up here, you get the option of depositing at least $100 and getting a free stock worth up to $1,000.

➡️ What to read next: 30 Ways To Cut Your Spending And Save Thousands Per Year

Best side hustles (making $1,000+/month)

- Sell printables on Etsy – Selling printables is the #1 side hustle to make money. This can be done on your own schedule and turn into passive income! You can earn over $10,000 a year selling printables.

- Sell dog treats – Make $1,000+ selling dog treats from the comfort of your home. Be your own boss and make your own schedule.

- Proofreading – Earn $20+ an hour proofreading from home. Great for people who enjoy editing and working from a computer.

Alexis Schroeder is the CEO and founder of FITnancials.

With budgeting and side hustles, Alexis paid off over $40,000 of debt and made over $100,000 in side hustles in college.

Since starting this website over 10 years ago, Fitnancials has reached over 3,000,000 readers. We’ve been featured on sites like Forbes, Yahoo, Side Hustle School, GOBankingRates, Mint, and many more.

If you want to contact Alexis, please send an email to alexis@fitnancials.com.